The digital revolution has redefined how we manage our finances. Peer-to-peer (P2P) payment platforms like Zelle App have streamlined money transfers, offering unparalleled convenience for everyday transactions. However, this rise in digital transactions has also opened doors for malicious actors, leading to a spike in Zelle scams. This guide explores the common tactics scammers use, the different types of Zelle scams, and, most importantly, how you can shield yourself from these cyber threats.

What is the Zelle App?

Zelle App, originally known as clearXchange, is a P2P platform enabling instant money transfers directly from your bank account to another individual’s account using just their email address or mobile number. Integrated with the mobile and online banking apps of numerous major banks, Zelle has become a widely adopted method for splitting bills, reimbursing friends, or paying for goods and services.

Types of Zelle Scams

1. Phishing Scams

- Modus Operandi: Fraudsters craft deceptive emails, SMS texts, or phone calls mimicking legitimate entities (e.g., banks, Zelle) to induce users into revealing their login credentials or sensitive information.

- Common Tactics: Clicking on fraudulent links in messages, redirects to fake Zelle websites designed to steal login details.

- Keywords: Spoofing, phishing attacks, credential theft.

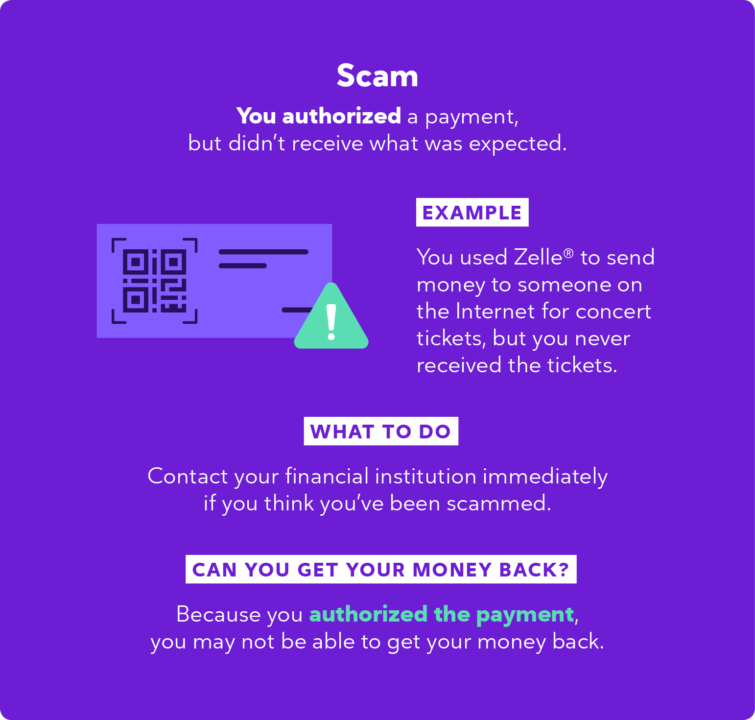

2. Fake Seller/Buyer Scams

- Modus Operandi: Scammers exploit online marketplaces, masquerading as buyers or sellers, insisting on Zelle payments exclusively.

- Common Tactics: Posting alluring deals to entice victims, disappearing with the payment without delivering the promised goods or services.

- Keywords: Online fraud, marketplace scams, buyer/seller impersonation.

3. Overpayment Scams

- Modus Operandi: Fraudsters overpay for a product or service via Zelle, requesting a refund for the excess amount.

- Common Tactics: Convincing victims to return the overpayment, only to later discover the initial payment was fraudulent.

- Keywords: Social engineering, refund scams, deceptive transactions.

4. Employment Scams

Modus Operandi: Scammers pose as employers offering remote work opportunities, requesting personal information like Zelle credentials under the pretense of setting up direct deposits.

Common Tactics: Using enticing job offers and urgency to pressure victims into divulging information.

Keywords: Job scams, remote work fraud, imposter impersonation.

How To Use Zelle Safely to Avoid Zelle Scams?

- Verify Contacts: Always confirm the identity of the person you’re transacting with, especially when buying or selling online.

- Embrace Two-Factor Authentication (2FA): Add an extra layer of security by activating 2FA for your Zelle account.

- Be Wary of Phishing Attempts: Exercise caution regarding unsolicited messages or emails requesting your Zelle credentials. Verify their legitimacy before taking action.

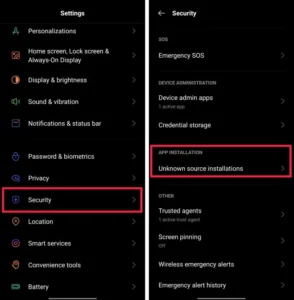

- Maintain Software Updates: Regularly update your mobile banking app, Zelle app, and device operating system to benefit from the latest security features.

- Stay Educated: Remain vigilant by studying up on the latest scams and cybersecurity best practices. Knowledge empowers you to recognize potential threats and prevent becoming a victim.

Final Verdict

Zelle offers a convenient and efficient way to transfer money, but vigilance is crucial to safeguarding yourself from the evolving threat of scams. By understanding these common tactics and implementing proactive security measures, you can continue reaping the benefits of digital transactions without jeopardizing your financial well-being. Remember, in the ever-evolving digital landscape, staying informed and exercising caution are your key weapons against financial fraud in the age of P2P payments.